Don't try to force an options trade, just be patient

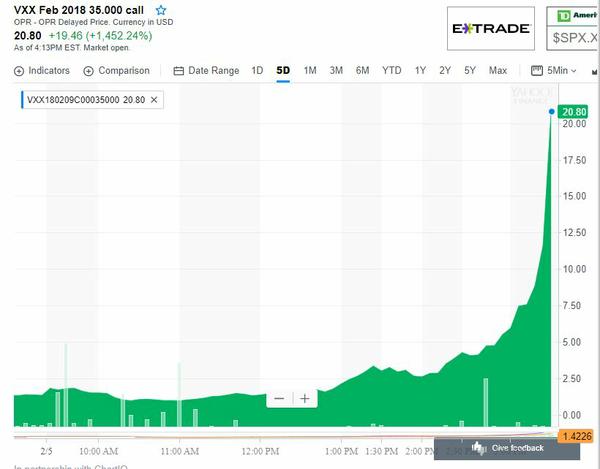

Wait for the setup MACD divergence and double top or bottom and then place the trade. A few hundred percent gain isn't too shabby in a few hours. Patience is the key. SPY weekly options rule.

Upside Divergence on MACD on VXXB returns 27 times your Money

For short term traders and short term charts, VXXB upside divergence on March 26/27 15 minute charts clearly shows us that the SPY would do the opposite and send markets down until the technical picture starts to stall and that’s the end of the move. Then you can spend the rest of the day counting the money you made.

SPY 278 puts at 10.30am went from 2 cents to 81 cents in a few hours.

Bearish MACD divergence on Intraday returns 500% in 30 minutes

SPY 281.5 & 281 puts were up about 500% from 11am to 11:35am Eastern time today just based on short term charts on an expiration day!

MACD divergence turns up the final piece in place

Its great having the MACD divergence in place but paying attention to the MACD turning up is the final piece of the pattern. If it hasn't happened then it's not ready. Patience is key to success.

WYNN had another 30 min Bullish MACD Divergence

Note how WYNN had another 30 min up divergence late Monday to add fuel to an already divergent daily chart! That’s how you successfully trade a new entry to an existing pattern! Low time frames form “another” divergence in the same direction as the higher time frames!

GS had decent daily divergences to the upside still on going

Some VXX downside divergence in latter part of Friday but not overly clear. GS had decent daily divergences to the upside still on going the XLF had a series of 60 minute divergences in play earlier in the week

Mirror Mirror on the wall - sort of

In many of our nightly updates we talk about the inverse relationship between the VXX, an ETF proxy for the Volatility Index and the market proxy SPY. A divergent MACD up or down in either frequently coincide with the opposite divergence in the other. As you can see from this overlay chart, the two ticker do indeed inverse each other.

The hourly chart of SPY is overlaid with the hourly chart of VXX, notice the double top in VXX at the same time as the double bottom in SPY

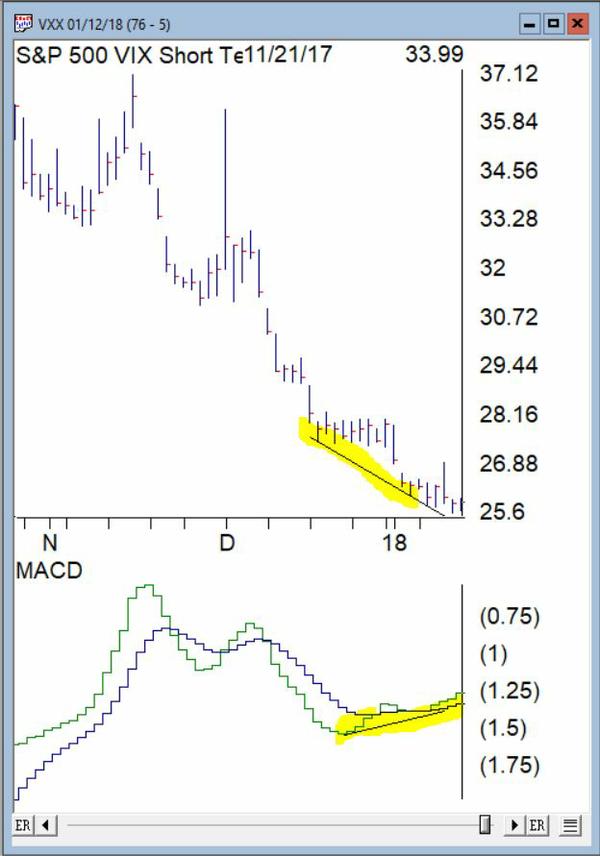

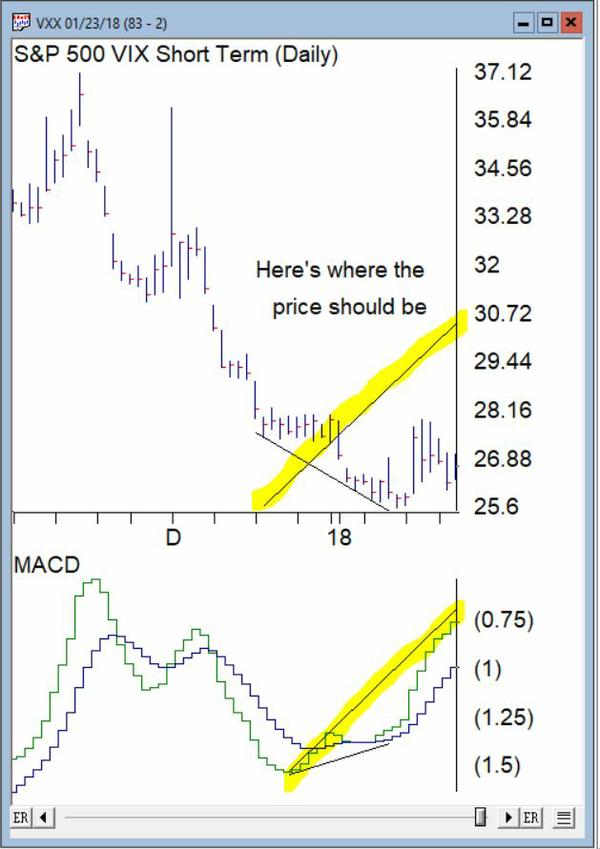

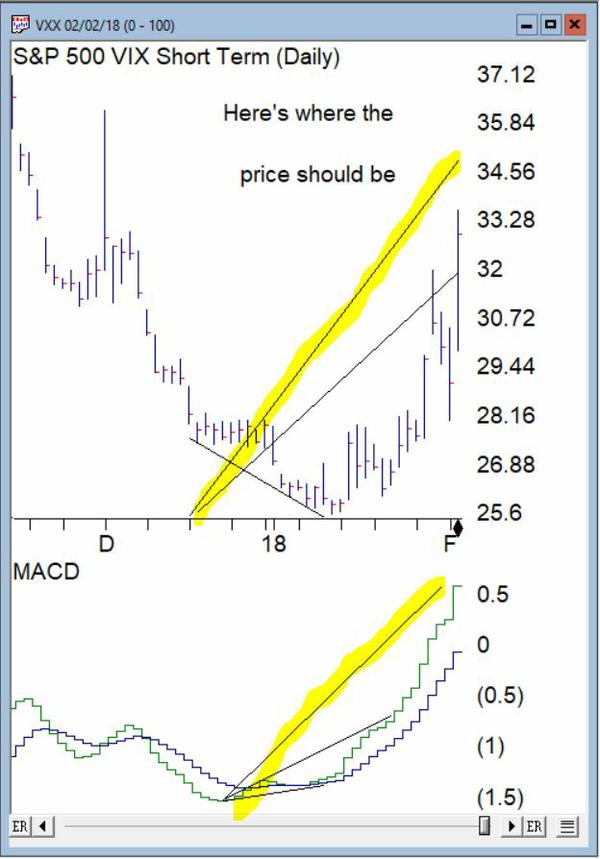

Volatility shouts out VXX – Forecasts the Move in Advance

Once again, the powerful strength

Daily VXX MACD has BEEN far ahead of the price(up divergence, hint hint)…… Great options trades!

Alaskan Air Soars

Alaskan Air Soars

We were all watching ALK after Tuesday's class. The divergence was a classic setup on daily charts on September 21, 2017.

By September 25, 2017 things were moving and those OTM options were locking in great gains. The Options Hunter tweet again reiterating the strength in airlines.

It was September 27th and The Options Hunters tweet says it all

We’ve been watching SPY MACD divergence since February

We’ve been watching the Weekly MACD Divergence on SPY setup for months. By mid-Feb the MACD was already signaling something was up. Then Mid-May SPY hit a new high, and where was the MACD? EVEN lower then the mid-Feb level. We played these divergences and we knew when the lower time frames started to diverged too, that the timing was right to make mega bucks in out of the money puts.