Why do we watch the UVXY in MACD Divergence

The markets are at a pivotal point - Join Dale live for 2 days

The markets are at a pivotal point this summer

The bear market on the NASDAQ is still in place, the recent rally has been all tech and mostly 8 stocks.

The Dow barely hit bear territory and is only 10% from it's previous high.

Meanwhile, the Russell 2000 is performing much worse.

Earnings are all over the map, and geopolitical events are skewing everything, and driving spurts of volatility.

Can we take advantage of these events?

YES. It's not the events themselves we care about. We want the volatility these events bring to us, and to use our Options Hunter strategy to leverage that volatility.

This July is your opportunity to be in the midst of events by joining Dale in his Live Trading Hours Zoom session July 12 - 13, 2023

Immersive, interactive, and intense, these sessions have been oversubscribed in January and April. Seats have suddenly started to fill up for the July event. We don't want you to miss out.

...

UVXY classic Volatility Setup

Check out this powerful hourly chart on the UVXY, the volatility ETF. A powerful divergence to the downside, indicating Volatility was about to head down, and of course, the markets were going to head up.

This event occurred after 4 hours of trading Wednesday, March 15, 2023. The same pattern was clear on the 2 hourly charts and gave us confidence that the trade could last longer than if this had been on a short time frame like 15 minutes.

As expected the SPY was showing the opposite of UVXY, indicating a potential move to the upside 4 hours into the trading day.

The SPY 392 Calls expiring Wednesday, March 15th, despite only a few hours until expiration, could have been had for @5c and rose to a high of 50c within 45 minutes.

The strength of the UVXY hourly and 2 hourly divergence drove the SPY higher into the next trading day, March 16th. The SPY call options expiring the 16th, for example, the 395 calls could have been had for 5c and rose to...

UVXY classic Volatility Setup

Look at that second hour of trading on Thursday, a powerful divergence to the upside on UVXY on the hourly chart, indicating Volatility was about to head up, and of course, the markets were going to head down.

By late Friday the UVXY had risen over 50%

That powerful upside divergence on UVXY gives us confidence that the markets like SPY are likely to move lower. Here you can see SPY moved down from the 400 level to 386 rapidly over the 2 days.

The SPY 388 Puts expiring on Friday March 10th were one of many OTM options available that Thursday morning. On Thursday the 8c option rose to around $2. On Friday as high as $3.95.

Spend 2 days with Dale and live market action

April 5 and 6, 2023

Focus on SPY and QQQ options

PLEASE NOTE: We're limiting the number of attendees

Don't hesitate or you'll miss out.

Limited Seats Low Price Revealed at https://www.theoptionshunter.com/zoomlivetrading

Before Mid-November 2022, we could only trade QQQ and...

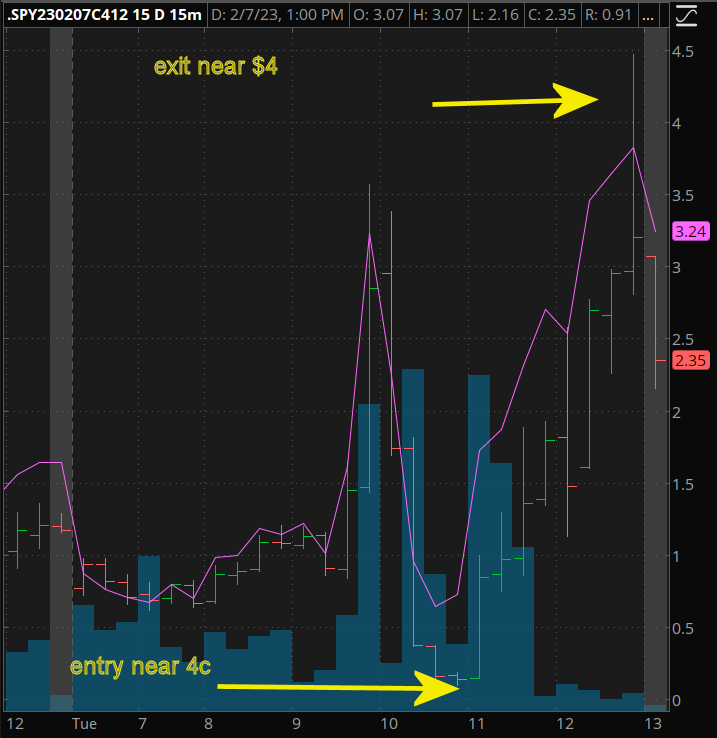

4c to $4 in 90 minutes SPY calls February 7, 2023

On February 7th we watched the SPY move up strongly to a high of 415 around 9.30 am PST (12.30 eastern) before falling back rapidly to 408. During this period the MACD diverged to the upside. The MACD indicated prices should be nearer 412. As we have options expiring today on SPY we can look for an out-of-the-money option under 10c a contract.

With only 3 hours remaining in the trading day, this trade will be very short-term. The nearest out-of-the-money option expiring February 7, 2023, and with a price under 10c was the 412 call with an entry around 4c.

Entering the trade at 11.10 am PST, 90 minutes later the option was trading above $4

How do we do this?

The Options Hunter strategy focuses on divergencies between the MACD and the price movements of the underlying ticker. We don't include other indicators such as RSI, Stochastics, or Bollinger bands as our approach is kept simple, straightforward, and repeatable.

The main difference between weekly and...

We spotted this February 2, 2023 SPY divergence winner

On February 2, 2023, the 15-minute chart of SPY was headed to a new high of around 418 at 11:00 am PST. the MACD was diverging down strongly indicating prices should be nearer 412. As we have options expiring today on SPY we can look for an out-of-the-money option under 10c a contract.

With only 2 1/2 hours remaining in the trading day, this trade will be very short-term. The nearest out-of-the-money option expiring February 2, 2023, and with a price under 10c was the 410 put with an entry around 3c.

Entering the trade at 11.10 am PST, we rode this up to around 18c before exiting after 40 minutes for 6x your money.

How do we do this?

The Options Hunter strategy focuses on divergencies between the MACD and the price movements of the underlying ticker. We don't include other indicators such as RSI, Stochastics, or Bollinger bands as our approach is kept simple, straightforward, and repeatable.

The main difference between weekly and monthly options is their...

The hourly upside divergence on January 18 on the UVXY and matching downside divergences in every major index

Well, the markets did what I expected! How about you? The hourly upside divergence on January 18 on the UVXY and matching downside divergences in every major index has led to a great move that takes the pressure off from only looking at short-term charts!

Here's the clear divergence and double bottom on UVXY hourly completing at the first hour of trading on January 18, 2023

The SPY showed a divergence in the opposite direction with the increased volatility.

Looking at Out-of-the-money puts expiring the same day January 18, 2023, the 392 Puts were as low as 4c after the first hour of trading and reached over 50c in 2 hours.

The Options Hunter approach focuses on divergences between the MACD and the price action. We don’t employ other indicators such as RSI, Stochastics, or Bollinger bands as we keep our approach simple, straightforward, and repeatable

What are Weekly Options and Why Do I use them?

Weekly options are a great way to make money, but...

Quick profit SPY 10/221/2022 - then a rentry

If you're like us, and watching the SPY intraday, you will have seen this one on Friday 10/21/2022. The first 15 minutes of the trading day gave us this MACD divergence. At this timeframe, nimble traders took a chunk of change on call options.

As usual we look for out of the money options, with low premiums (expiring on the same day 10/21/2022), and trading at 10c or under.

We found the SPY 374 calls, expiring 10/21/2022 with premium at 10c, and entered the position. Within 25 minutes the price shot up to over 50c. A quick exit netted us 4 times our money as the lower timeframe MACD turned down.

If you took your eyes off the ball you'd have given back half this gain within 40 minutes of entry.

Not a bad start for a Friday. A possible rentry can be seen below on the same 15 minute chart when the MACD turns back up. The same 374 calls were trading around 6c this time.

The calls were over 1.00 later in the day, although exiting on pullbacks would likely...

Did you see this divergence on SPY right at the start of the day on October 13, 2022?

Prices dropped sharply on SPY in the first hour of trading on October 13, 2022. The MACD on the hourly chart clearly shows SPY should be higher in price.

The hourly divergence on the 13th showed us prices should be higher.

Time to look for some calls expiring the next day . We want low premiums so we want:

- Out of the money options

- Trading at less than 10c

- Expiring as soon as possible (October 14th)

In the first hour of October 13, SPY was trading at 348. nearby out of the money options in the 348 - 368 range were over 10c. Options too far out of the money like 380 or above have insufficient time to gain headway.

We selected a middle ground and bought the SPY 370 calls expiring October 14th, for under 10c. The 15 minute chart shows the SPY 370 calls expiring October 14th trading up as high as 1.60 with an entry under 5c during the day on October 13.

Over 10 times your money in one morning

Did you see this divergence on SPY right at the end of the day on Friday September 30, 2022

The MACD on the 30 minute chart clearly shows SPY should be higher in price. We waited until Monday October 3rd in the first hour of trading and still got in at under 10c an option. Let me explain.

The 30 minute divergence on the 30th showed us prices should be higher.

Come Monday morning, we started looking for options on SPY. We want low premiums so we want:

- Out of the money options

- Trading at less than 10c

- Expiring as soon as possible (October 5th)

In the first 30 minutes of October 3, SPY was trading at 361. nearby out of the money options in the 362 - 375 range were over 10c. Options too far out of the money like 382 or above have insufficient time to gain headway.

We selected a middle ground and bought the SPY 379 calls expiring October 5th, for under 10c. The 5 minute chart shows the SPY 379 calls expiring October 5th trading up as high as 25c with an entry under 5c during the day on October 3.

Clearly between 5 and 10 times your money.

Want to learn how we do this?