Back to Basics

In this 90 minute video edited from a recent Options Hunter live webinar, Dale Wheatley takes us through a daily routine using mostly daily price charts.

He starts with major indices and ETFs then moves on to the Dow 30 stocks. When there are no patterns within the major markets or ETFs, there are often patterns in the Dow 30 stocks. These stocks represent a cross-section of industries and chart patterns can often set up in industries independent of the major markets.

He rejects charts that are not clearly distinguishable or have confusing patterns to focus in on clear patterns with divergences. Dale also provides an in-depth look at AAPL in June 2017 and potential trades that triggered.

GILD 6-20-2017 anatomy of a divergence

A strong daily MACD divergence and with a triple bottom on GILD 6-20-2017 signaled a strong move to the upside. OTM options moved thousands of percent in 2 days.

Bullish MACD Divergence on the 30 minute chart for IWM

Bullish MACD divergence occurred on the 30-minute chart on IWM. Divergences occur in all timeframes and the decision to trade is based on the traders' Timeframe.

A tweet is worth a thousand words These tweets on SPY were in real-time as the pattern setup

1. At 10:24am subscribers received the first warning

2. At 10:39am subscribers received the second tweet highlighting the strengthening pattern and divergence

3. Here’s the 3 min divergence. Remember you first heard about this at 10:24am

4. The pressure of the MACD divergence forces the prices back up, as the MACD turns back up at around 10:34am that’s the time to buy OTM puts.

5. 200% in 9 minutes, remember that first tweet at 10:24am warning you this was coming?

200% in 9 minutes trading SPY options. Find out how you can do this. http://bit.ly/2obxEXw

Multiple Time Frame Confirmation is a the Key

I know you’ve heard the story before, but I wanted to make sure everyone understands how the MACD divergence works. If you’re going to trade the lower time frames, you know the 1 minute, 5 minute, 15 minute etc, you’ve gotta be there to see the setups and you MUST trade quickly. These setups don’t last very long. They can be huge and if the higher time frames all line up it can be even more powerful.

So if you were watching the lower time frames on the SPY toward the end of the day on Tuesday 2/28/2017 you’d have noticed this MACD divergence setting up on the 5 minute charts. The slope of the MACD shows us prices should be higher.

Within 15 minutes out of the money calls on SPY expiring March 3, 2017 would have netted you a nice gain. You could have exited the trade just before the end of the day and walked away. But if you’d held these options overnight…….

The Trump effect? Probably. The out of the money options from the...

Long-Term Bullish MACD Divergence starts a GOLD run

December 2016, the Options Hunter weekly members live webinar highlighted the ongoing divergence on MACD 4 days before the start of 2017. Our divergence analysis revealed the gold mining stocks were ready to soar. Out of the money options on stocks like GG soared 100s and even 1000s of percent on December 28 and 29. We warned you

MACD Divergence forecasted 400 point drop VXX MACD Divergence forecasted Big Plunge

So the market dropped almost 400 points on 9/9/16. The VXX showed us the best divergence on the 60 minute time frame, the day before. Options Hunter subscribers to SHARPSHOOTER and BIG GAME received the update the night before and could reap the rewards from this option trading strategy.

Here’s a comment Options Hunter subscriber Lud Mayles

Dale,

Yesterday in the afternoon the VXX showed a pattern and

I took a VXX 34.5C .09 out 2.99. Your update last night

was welcome confirmation regarding what I saw.

Thanks again.

Lud

MACD Continuation

Moving Average Convergence Divergence or MACD is one of the most popular indicator that traders use when it comes to stock market. The indicator is composed of exponential moving averages, which determines the MACD by subtracting the 26-day exponential moving average from the 12-day exponential moving average. In addition, the 9-day exponential moving average that serves as the signal line and it functions as the initiator for the basic buy and sell signals. The indicator helps the traders on how they can find an entry or exit point when it comes to trade.

The continuation pattern in the MACD is useful for traders where they can find an entry point in a current trend. Buying into these trends using the MACD indicator, often yields high profits for the trader.

When you use the continuation pattern for MACD, always keep in mind that the values do not work in straight line. The prices move in a manner like a wave where the MACD line can be seen to head back...

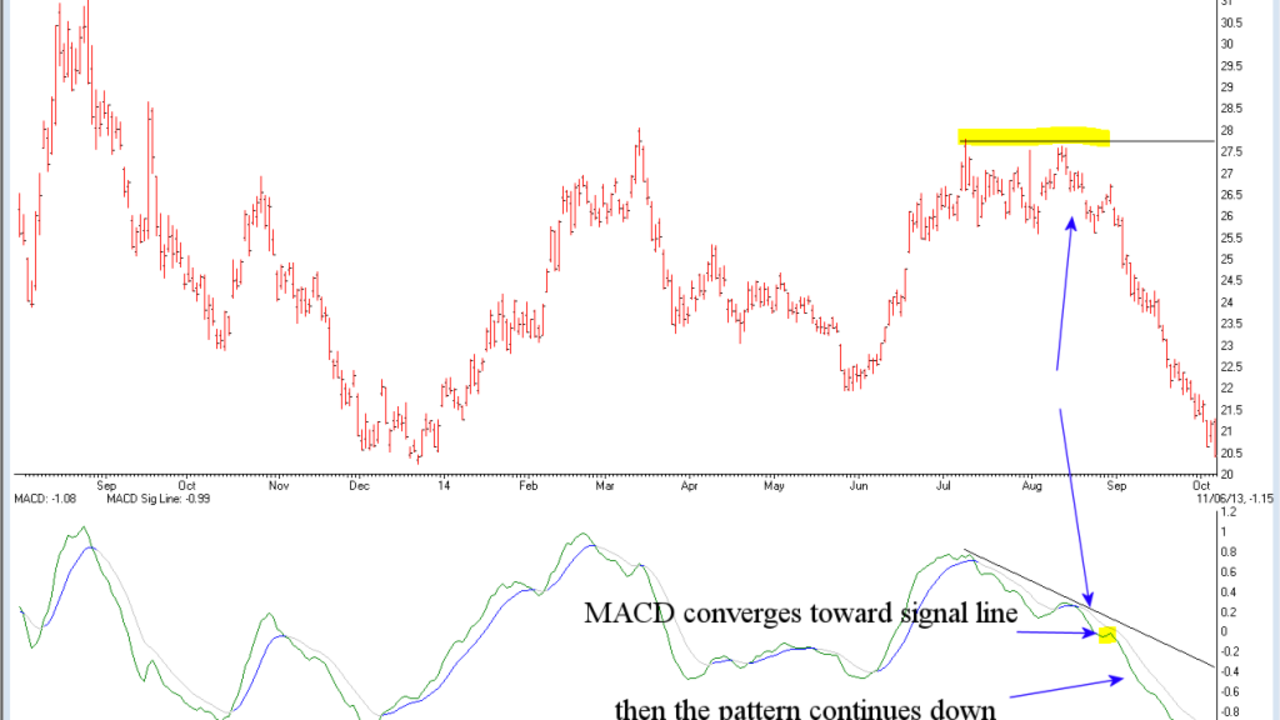

Daily MACD Divergence signaled GDX decline

During my Tuesday, August 16 live webinar , I discussed the short term weakness in Gold Miners(GDX) apparent in the daily MACD divergence. Here’s the Chart, GDX made a new high on Friday, August 12, but the MACD clearly did not, and was in fact, lower, indicating prices should be below $30.

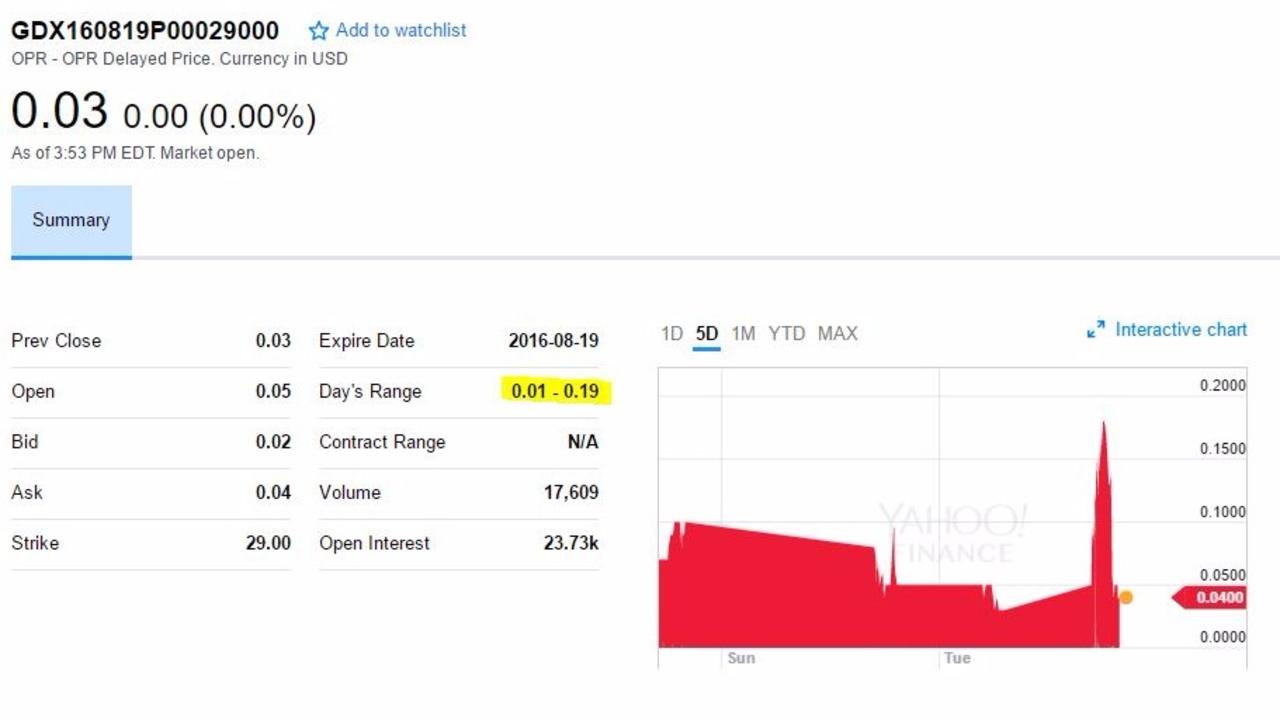

I reminded my BIG GAME subscribers early this morning with this premium tweet that only they receive. The weakness was still in place and ripe for us to exploit using our standard modus operandi; out of the money options and under 10c a contract.

With our target under $30 the GDX $29 puts looked a good option and they were under a dime. Boy did they rise fast, as high as 19c from an open of 5c that’s pretty good for a short-term trade. That’s the power of out of the money options.

Bullish Daily MACD Divergence shows Airlines are ready for Take-Off

We’re not saying

I told you so, but we did!!

Airlines soared last week

This was my tweet on Monday July 11, midway through the trading day. At that time airlines had just begun to move. UAL United Continental was trading at $42.50

The daily divergence clearly indicated the price should be around $47!!! How do I know that? look at the slope of the MACD in the Chart below and you can see where UAL SHOULD BE.