Even on quiet market days there's money to be made

Jul 21, 2023Take July 19, 2023. On the 15-minute chart of the UVXY, the technical picture had been getting higher while the price was generally lower. Notice the early precipitous climb in UVXY as a consequence of the early trading on 7/19/23.

This picture suggests increased volatility and an opportunity for us to look at puts on the major market ETFs during the morning of 7/19/23. Looking at the QQQ during that morning period, the pattern is not perfect but there is a definite divergence in place on the MACD.

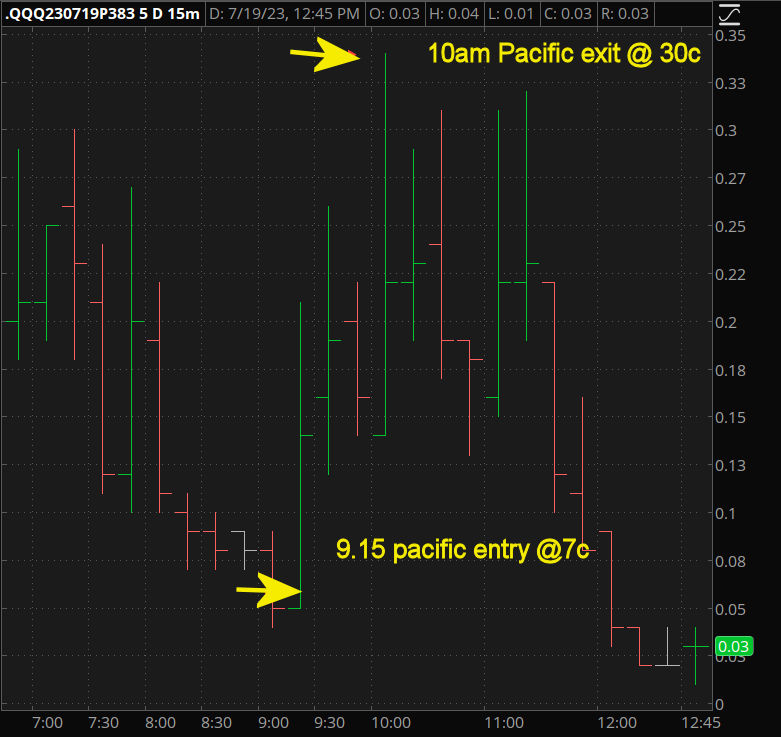

Nimble traders buying the QQQ 383 calls expiring that day, 7/19, could be had for around 7c. Exit within 60 - 75 minutes for around 30c. for 4 times your money. Not our best pattern ever but still not bad.

You can see later that same day that the MACD fell in line with the move down on the QQQ and our puts gained in value. Once we exited as technicals turned around, you can clearly see MACD failed to break the Signal Line and turned back down at the end of the day, offering a reentry point for QQQ puts the next morning next day.

You can see later that same day that the MACD fell in line with the move down on the QQQ and our puts gained in value. Once we exited as technicals turned around, you can clearly see MACD failed to break the Signal Line and turned back down at the end of the day, offering a reentry point for QQQ puts the next morning next day.

Entering OTM puts in the first 15 minutes of 7/20/23, there were many choices. Here we chose the QQQ 377 puts expiring that day entry was around 7c and exit within 45 minutes was around 36c once lower timeframe technicals turned around. Definitely one for the nimble trader.

If you held onto this option and ignored the lower timeframe (5-minute technical exit), you could have ridden this rollercoaster up to $2. or you could have reentered again for another big gain on the same option when MACD failed again to break the signal line and turned back down.

As traders, we know Options are the best choice when you want to limit risk. In-the-money options can allow us to earn a stock-like return while investing less money and are a useful strategy when you're an investor.

With The Options Hunter strategy, we use out-of-the-money that can make far greater returns. Want to make trades like these?